We’ve all experienced the disappointing (and kinda embarrassing) moment when we’re at a register trying to buy armfuls of tortilla chips and salsa, and the point-of-sale card reader screams out that an error has occurred.

For credit and debit card manufacturers, these are the moments they want to avoid being the cause of. A lot of factors go into being what the industry calls “top of wallet” for consumers. Much of what makes a person reach for a card over others at their disposal has to do with the bank it’s connected to, rewards associated with the use of the card, relative balances they have on a card, and so on.

But the basic functionality of each card is far from meaningless in the fight for the most coveted position in a person’s coin purse. Card manufacturers understand the role they play in making sure that when we reach for a means to pay for a burrito at our favorite food truck, we reach for the card they produced.

A faulty card due to delamination or debonding layers of the card materials can dissuade someone from wanting to put up with the hassle of the card not being quickly and easily accepted. Moreover, when cards begin splitting at the interfaces of their layers, sharp plastics and metals can become dangerous to handle.

These kinds of defects can redound to major reputation damage for the companies that issue the cards. The more a card manufacturer can protect the companies they produce cards for, the more likely they will continue to grow business with those companies.

Rethink your adhesion manufacturing processes with Surface Intelligence.

Not only do card manufacturers need to be aware of and responsive to the end user’s experience, but they also need to maintain an efficient and waste-free production process. Doing so requires innovative technology and ways of collecting data that reduce scrap, create process standardization, and cut down on time costs.

With Covid-19, purchasing habits have shifted dramatically and quickly. Cash has taken a dive as a preferred method of paying for things. Financial concerns are making credit cards look both more attractive than debit cards (since available money is likely to be smaller for many people), yet also more frightening since taking on debt that may not be as easy to pay off as it was a year ago doesn’t feel like a safe move right now.

Touchless payments made over the internet and by waving your phone over a pad to use Apple Pay at checkout have become increasingly popular as people are reluctant to leave their homes if it’s not absolutely necessary. Card usage has increased slightly over the last year, but it’s impossible to predict if that will last, making it very important for card manufacturers to meet this moment with efficient processes that can produce reliable and functional cards that people want to use.

A Brief History of Credit Cards and Card Manufacturers’ Dilemmas

A credit or debit card appears on its face to be a simple enough piece of plastic, but, much like the paper money it’s an alternative to, these cards are technological marvels that embody decades of design enhancements to prevent forgery, protect people’s private information and make buying things with them easier.

To learn more about how to build an adhesion process that will increase throughput, reduce costs and provide actionable data, download our eBook: The Manufacturer’s Roadmap to Eliminating Adhesion Issues in Production

Cards as a means of paying for something on credit wasn’t a new idea by the 1950s but with the advent of the Diners Club Card and American Express, paying for things like entertainment, dining out, and travel without having the money upfront spawned all modern incarnations of this kind of transaction. Technological advances in cards were born out of a necessity to make credit card authorizations speedier and safer.

The magnetic strip on the back of cards that sent information to banks over phone lines was a game changer. But countries with less than stellar phone line infrastructure were vulnerable to massive fraud, which led to the invention of the EMV chip that is now ubiquitous and computing power comparable to that of the tech used to send the Apollo 11 space shuttle to the moon.

All that to say, cards are now made up of multiple materials, embedded safety mechanisms, and highly sophisticated technology making each card more expensive and more complicated to produce than ever.

To learn more about how EMV chips are produced before they are inserted into cards, read our recent article on semiconductors and the crucial role adhesion concerns play in making these tiny computers.

Since cards are no longer just rectangular pieces of single-layer plastic, the materials used have to go through a series of treatments, cleaning, and processing to ensure that the cards withstand years of constant use and abuse being crammed into wallets and handbags.

One of the biggest struggles for card manufacturers has been adequately cleaning the metal components of cards so they create a strong bond with the polymer layers. Overcoming this issue has included instituting washing processes that hadn’t previously been employed.

Cleaning metal is very different from cleaning polymers in many ways. Metal surfaces are, in general, more innately reactive than polymer surfaces and can build up layers of oils, residues, and oxides that make adhesion difficult. Cutting through these substances and creating a surface that is ready for bonding requires industrial washing processes using cleaning chemicals and thorough rinsing.

With polymers, the process often includes an activation step utilizing plasma and/or corona treatment to break molecular bonds on the surface of the material. These broken bonds become active sites on the surface of the polymer that are very eager to create new bonds with molecules introduced to them.

The interface between the treated and cleaned surfaces and the adhesive or laminate placed on them is highly susceptible to adhesion failure if the treatment or cleaning is insufficient. Controlling these processes and optimizing the equipment used is the best offense manufacturers can employ to create reliable, consistently functional cards. Residues and other invisible contaminants left on the surface weaken the bonds and make cards vulnerable to delamination and malfunctioning.

Reducing Operational Costs Through Process Monitoring

When a card manufacturing process is equipped with systems that reveal quantifiable differences between “good” and “bad” parts, this allows for thoughtful adjustments to be made that reduce “bad” parts and develop a process more capable of outputting only “good” parts. When this logic is applied to the surface quality of materials that go through cleaning and treatment processes, then one of the most overlooked aspects of manufacturing is no longer left up to chance.

The cleanliness of a surface depends on process steps that occur even before the materials are in the final assembly facility. Plastic blanks, metal sheets, and microchip components often are supplied by vendors, and manufacturers need clear, data-driven ways to communicate the changes their suppliers make.

Traditionally, card manufacturers have relied on subjective and imprecise information gained through surface quality evaluations like dyne ink and water break tests. These tests are prone to inaccuracies and have done little to nothing to prevent failures due to inefficiencies in cleaning and treatment processes.

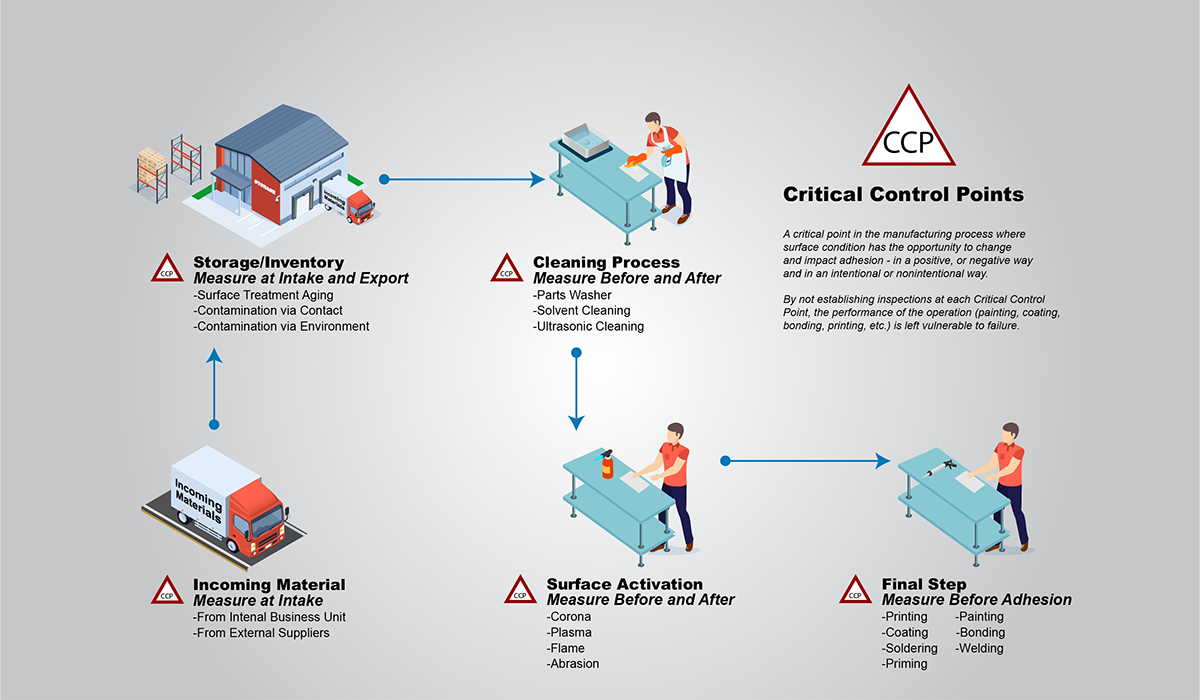

A key aspect of creating a seamless surface quality process has been the ability to automate evaluations and/or use mobile devices that can easily identify changes in surface quality at each process step. Being able to say with confidence, after extrusion, the surface quality is this number, then after treatment, the surface quality is this number, and then before laminating or printing, the surface quality at this number makes a direct connection between the beginning and the end of the process. Thinking holistically about the process and understanding the interconnectedness means manufacturers can collect data that reveals where inefficiencies exist and precisely what parameters need to be optimized.

It’s fast. It’s accurate. It’s non-destructive. It’s the Automated Surface Analyst.

In an interview with ICMA (International Card Manufacturing Association), Peter M. Krauss, president and CEO of Arroweye, discussed how this kind of thinking changed his company’s perspective on the “war on waste.”

“We took a step back and evaluated our entire workflow and focused on using technology to capture data,” Krauss said. “The minutes and hours that we can save in our process—that translates to gains in efficiencies and profits. If a card manufacturer has a high scrap rate of 20-30% and they don’t know how that scrap is happening, that is an instance where the company should use technology to track and report on that data to make better business decisions,”

Waste is a major issue for card manufacturers, and it can occur at any point in the production process as a consequence of over-processing, punching skeletons, printing defects, or lamination imperfections. Handling waste can often be a part of a larger push towards sustainable manufacturing practices that consumers increasingly demand. Reducing scrap makes good business sense from every angle.

Material Complexity Adding to Manufacturing Complexity

As a consumer item, credit and debit cards are statement pieces that convey something about the person it was issued. Premium credit cards have long been used to differentiate those that possess these elite status cards with more intricate designs, gold and silver flourishes, and heightened security features.

There has also been a continual drive to push the boundaries of artfulness in card design, making them another indicator of the personality and interests of the holder.

Dane Whitehurst, creative director of Burgopak Ltd., told ICMA, “A plastic card isn’t just a bank card or a gift card, it is a ‘membership card. In the absence of a handshake, the way it is presented through its packaging fundamentally defines the first, ‘Hello, welcome to the club.”

Innovation is at the heart of this industry, from treating the cards as little blank canvases to displaying artwork or improving the security of digital information stored on the cards. This innovation comes with novel materials and processes that need to be monitored and understood in order to predict their impact on the adhesion process. Adding in magnetic material, recycled plastics, additional metals, inks, and dyes can alter the chemistry of the surface and need to be controlled to maintain the consistent performance of all cards.

Objectively defining successful processes that scale makes introducing material changes easier if manufacturers can quickly collect precise data on the impact of these changes. This will reduce the costs of revamping a process or dealing with the unforeseen deleterious effects of materials not bonding after the fact.

Guarding manufacturing processes with predictive maintenance systems removes the need for more reactive preventive maintenance. You can effectively ensure that the highest quality products possible will come out of production when you can draw a direct line from development to the final assembly through detailed data communication between all critical control points where surface quality has an opportunity to change. Mapping out the entire adhesion process with an easily trackable metric reveals vulnerabilities and makes it possible to do something about those vulnerabilities.

To learn more about how to build an adhesion process that will increase throughput, reduce costs and provide actionable data, download our eBook about the most fundamental issues manufacturers face daily. The information in The Manufacturer’s Roadmap to Eliminating Adhesion Issues in Production will help manufacturers increase efficiency and delight more customers.